Unify Partners with GoCardless to Revolutionize Rent Collection with AI-Powered Automation

Toronto, Canada – Unify is excited to announce a strategic partnership with GoCardless, bringing together GoCardless’ industry-leading ACH payment solutions and Unify’s AI-driven property management platform. This collaboration introduces a smarter, more efficient rent collection process within Unify’s all-in-one property management solution, designed to empower property operators with robust automation tools.

Redefining Rent Collection with Innovation

Traditional rent collection processes are fraught with challenges like late payments, administrative inefficiencies, human errors, and ineffective communications. This partnership addresses these pain points by integrating Unify’s AI-powered automation with GoCardless’s seamless and scalable ACH- Automated Clearing House payment system, creating an innovative and effective approach to rent collection. The swift and effective outcome underscored the strength of our partnership and its potential to deliver superior property management solutions across the globe.

Mutual growth: A Partnership Built for Growth

“This partnership ensures property operators can rely on a scalable, reliable payment solution that seamlessly integrates with Unify’s AI-driven rent collection tools,” said Jennifer Hwang, Product and Innovations Lead at Unify. “Together, we’re transforming rent collection into a streamlined, automated process that redefines property management.” The collaboration also represents GoCardless’s strategic expansion into the Canadian market, demonstrating its commitment to driving innovation and efficiency in the property management sector.

Key Features of Unify’s AI-Driven Rent Collection

Unify’s AI-powered platform brings advanced capabilities to property operators, including:

- Automated Rent Invoicing: Personalized, timely reminders delivered through tenants’ preferred communication channels to improve on-time payments.

- Predictive Payment Reminders: AI-driven analytics forecast late or missed payments based on historical trends, enabling proactive tenant engagement and minimizing default risks.

- Actionable Insights:Data-driven reports provide landlords with a deeper understanding of tenant payment behavior for better decision-making.

The Advantages of GoCardless Integration

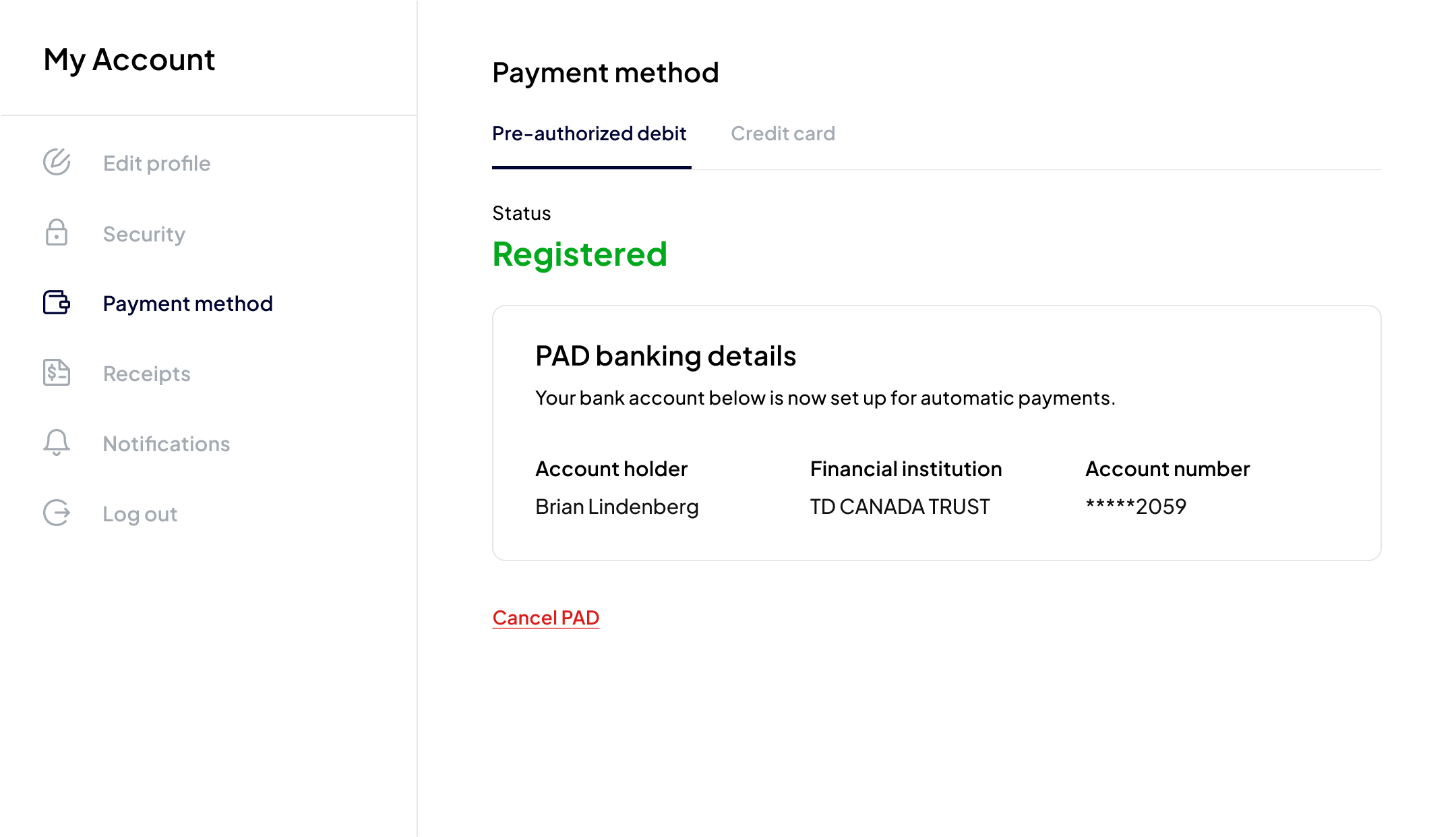

The integration of GoCardless‘s ACH payment system adds significant value to Unify’s platform by offering:

- Efficient Handling of Large Transactions: Perfect for high-value rental markets, enabling seamless processing of substantial recurring payments.

- Seamless Integration: Flawlessly complements Unify’s platform, providing a smooth experience for property operators and tenants. Pre-authorized payments can be set up for automated rent collection, enhancing the comprehensive property management solution within the LIV platform.

- Secured Payment: Advanced payment gateway system ensures secure transactions, with a strong emphasis on privacy and data security to build trust and maintain compliance.

- Competitive Pricing: A transparent and cost-effective fee structure that benefits property operators and tenants alike.

Transparent Pricing Advantages for Property Operators

GoCardless enhances Unify’s rent collection offering with a flexible and affordable pricing structure:

- No Monthly Fees: Businesses only pay per transaction, eliminating upfront costs.

- Capped Fees: Higher-value transactions benefit from capped fees, ideal for processing large payments.

- Simplified Financial Planning: Transparent pricing ensures clarity and confidence in managing payment costs.

Discover the Future of Rent Collection

Unify invites property operators to experience the transformative benefits of AI-powered automation and secure Pre-Authorized Deposit.

Schedule a no-obligation private demo session to explore how Unify can elevate your rent collection process, enhance tenant satisfaction, and optimize operational efficiency.

Discover how Unify can transform your real estate operations and unlock new growth opportunities.

For press inquiries or more information,

please contact: [email protected]